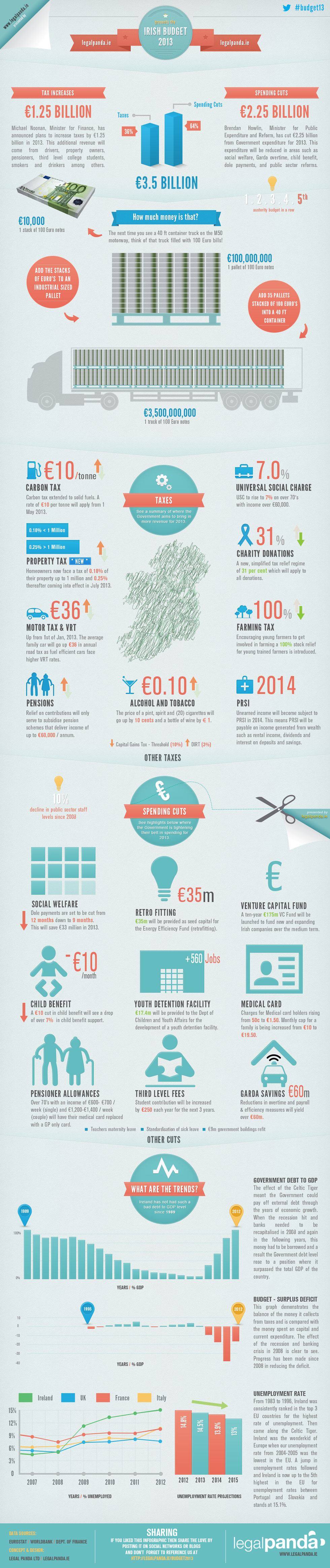

NOT SURE WHAT exactly happened today during the Budget 2013 announcement? Don’t have time to read everything?

The good folk over at Legal Panda have created this handy chart which outlines all the major measures revealed by Ministers Michael Noonan and Brendan Howlin.

Continue Reading →

DEC

Invoicing software

Invoicing software